There isn’t much you can do about the economy — keep focused on your Personal Financial Goals

Lately, I have had so many people ask me if we are heading into a recession. This seems to be the big question that is weighing heavily on the minds of some.

Last week, I was speaking with one person, who seemed to be thinking that this could perhaps be Financial Armageddon, and I asked, “Do you know what a recession is?”

She replied, “Not Really”. That’s why I am asking you.” Okay Fair point.

While some media headlines have suggested we are already are in a recession, lets take a look at what a recession is from a definition.

“A recession is a temporary period of time when the overall economy declines; it is an expected part of the business cycle. This period usually includes declines in industrial and agricultural production, trade, incomes, stock markets, consumer spending, and levels of employment. In purely technical terms, a recession occurs when two or more successive quarters (six months) show a drop in real gross domestic product (GDP), i.e., the measure of total economic output in the economy after accounting for inflation. In this sense, recessions are broad and can be particularly painful and challenging times for a country.”

A recession is simply when the economy slows down for at least six months. That’s it.

In Canada, recessions can also occur regionally because each province has exposure to different industries that are affected by different variables. A recession can occur in Alberta, for example, if the oil and gas markets decline, but not occur at the same time in Ontario if manufacturing and services remain steady, or vice versa.

Recessions do not occur very often because expansion usually occurs in the economy. Canada has experienced a total of five recessions since 1970 and twelve since 1929. Historically recessions have lasted between three to nine months; the most recent, the 2008–09 Global Financial Crisis, also referred to as the ‘The Great Recession’.

Here is an analogy. You are driving 50 km/h and you come across a school zone. You slow down to 30 km/h, then the school zone ends, and you resume driving 50 km/h.

Think of the car you are driving as the economy. You are humming along, then you slow down, then you resume your speed. Not really that scary, is it? During a recession, the economy continues to grow, just at a slower speed. Similar to the car analogy, you continue to drive through the school zone, just at a slower speed.

Recessions will occur over time, but they are not the financial Armageddon like the media portrays. The reality is you might experience a dozen or more in your lifetime.

Now, please don’t get me wrong. I am not saying that they are fun, and I am not saying that some people won’t lose their jobs, or that some businesses won’t go bankrupt in a recession. Most definitely, some people will lose their jobs, and some business will go bankrupt. Unfortunately, bad things happen.

Keeping things in perspective, bad things do not just happen during a recession. Let’s agree that economic casualties are bad irrespective of where we are in the economic cycle, and just focus on the concept of a recession for now.

So, if recessions happen as part of the economic cycle, and they are relatively short lived, what is all the fuss about? We know there will be some contraction in the economy but to be blunt, the 24/7 media machine needs to talk about something, don’t they?

Do you remember the Greek sovereign debt crisis? No? Well, not many people do. But did you know it lasted from early 2009 to late 2010. For six months in 2009, Greek debt was the big story that everyone was focused on until the next crisis of the day came along.

Now, an economic slowdown is a little more complicated than just the fear of what might happen.

Right now, we are dealing with the worst inflation seen in 40 years. Setting aside the crisis in the Ukraine, the surge in inflation we have seen since last spring largely reflects pandemic-related shifts in global supply and demand.

Looking specifically at Canada, we have three key elements that are driving inflation. The first is the global shift toward goods and away from services, combined with pandemic-related disruptions to supply chains. The second is a broadening of price increases to everyday items like food and energy, making it more difficult for consumers to avoid paying higher prices. And the third is the strength of the Canadian recovery and the overall balance between demand and supply in our economy.

The Bank of Canada has an inflation target of 2%. One of the tools it has is to raise interest rates which started in March of this year. The primary reason the Bank of Canada raises interest rates is to cause a slowdown in economic growth. Interest rates determine how much it costs for consumers and businesses to borrow. When rates increase, borrowing typically decreases. The Bank of Canada hopes that by raising interest rates, consumers reduce spending and businesses delay new investments, which will help lower demand and temper prices.

We need to remember that measuring the economy is not instantaneous. It takes time for these measures to work through the system which is why we hear some economists say we are already in a recession. And since recessions might be as short as three months, a recession could be over before the official numbers come out.

So, what are you going to do about all this? Well, unless you run a central bank or a multi-national corporation, there isn’t much you can do about the economy. But what you can do stay focused on your personal financial goals. Tune out all the white noise and remember the 10 Truths About Investing.

- Diversification is your most important strategy.

- It’s time in the market that matters, not timing the market.

- Someone’s portfolio will always be doing better than yours – or at least they say it is.

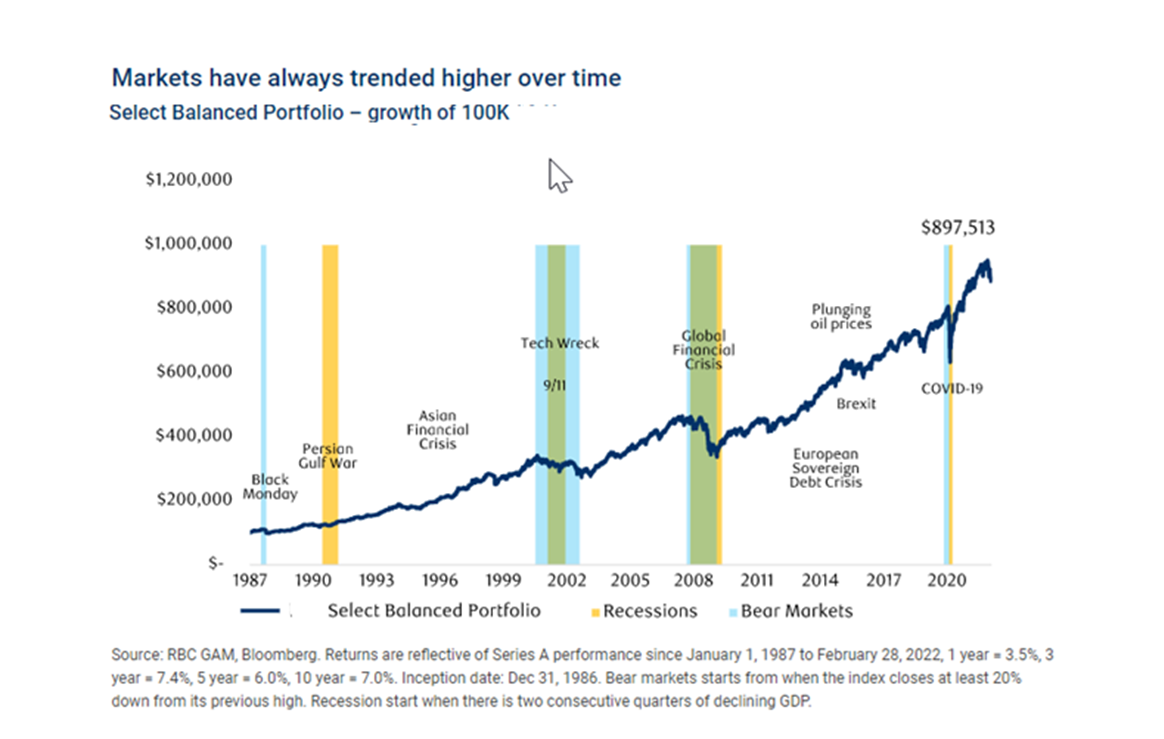

- Markets go through up and down cycles, but the have trended higher over time.

- Markets are unpredictable, so focus on what you can control.

- What matters isn’t what the market does, but what you do in response.

- Volatility decreases the longer you are invested.

- The more frequently you check your portfolio, the more volatile it will feel.

- Risk doesn’t look like risk when it’s earning a return – manage risk don’t avoid it.

- Headlines often focus on the sensational, short term and negative – none of which should matter to investors.

Stay well, stay safe and stay focused on your financial goals!

Footnotes:

https://www.bankofcanada.ca/2022/03/getting-inflation-back-to-target/

https://www.bankofcanada.ca/2022/03/economic-progress-report-controlling-inflation/

https://www.thecanadianencyclopedia.ca/en/article/recession

This article is intended as general information only and is not to be relied upon as constituting legal, financial, or other professional advice. Information presented is believed to be factual and up to date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change