Let’s talk Investment Fee’s

This seems to be a hot topic within our professional associations, investor groups and the media. And its something that we should all understand and be aware of.

There is one issue that comes up with several colleagues and that is the advertisements we seen on TV. In particular, the Questrade ads which claim you could retire 30% richer. These ads could be confusing, because the first thing that comes to mind is; can they generate that much more of a return? After all, we are all largely programed to think Rate of Return.

However, this is not what they are referring to, and in fact they are referring to Investment Fee’s. The impact that Investment Fee’s play on your portfolio can be significant over time. Let’s look at an example of how Investment fee’s can impact your portfolio:

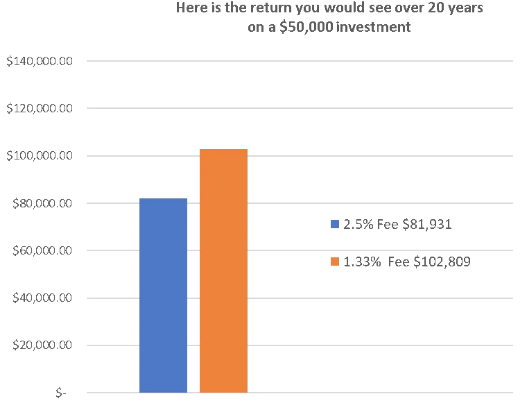

If you have a starting portfolio with a value of $50,000.00, with an average rate of return of 5% over 20 years

Data: BC Securities Commission

Paying a 2.5% fee rather than a 1.33% fee on your $50,000 investment could reduce total returns by more than $20,878 over 20 years, assuming a 5% annual return.

Even a 1% difference in the fees you pay can have a big impact on your investment returns.

Understanding Investment Fee’s is important as I have demonstrated, but we cannot discount the value that a Professional Financial Advisor provides. Studies have shown that households that engage the services of a Professional Financial Advisor have 4.2 times the median assets verses households that do not use a Financial Advisor.

Professional Financial Advisors do more than help Canadians save for their future. They help protect the savings their clients have accumulated through comprehensive planning and deploying strategies using a wide range of life and health insurance and investment strategies. Employing the services of a Financial Advisor, clients are better protected today, and are better prepared for retirement than people who do not receive advice.

Understanding your Investment Fees is important, and once you do, you can evaluate the true cost of the investments in your portfolio and the services you are receiving from your advisor.

Remember, lower fee options shouldn’t reduce the value of services provided by your Advisor. Make it a habit to ask questions about Investment Fees, after all it is your money.

Would you like to see if you could be receiving more value and advice while lowering your fees? Email [email protected] or call 778-215-7230 for a chat.

Want more Insurance and retirement savings tips? Sign up for our free newsletter on our home page. www.zakuskowalchuk.com

The information contained in this post is of general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed, and Zakus Kowalchuk LLP assumes no responsibility or liability.