We are twenty-one days into what some advisors call “RSP season”, so we wanted to take a step back and help you better understand RRSPs and the benefits, here are the ABCs of RRSPs:

A: Automatic RRSP Contributions

Setting up an automated RRSP contribution plan (PAC) can substantially increase the value of your portfolio. Benefits include less stress as to when to invest, helps remove emotions from investing decisions, you avoid missing contribution deadlines, and you’re giving your money more time to work.

B: Behavioral Cash Flow Planning

With the holidays now over, you are probably avoiding your credit card statement and your bank account balances. The holidays can be an expensive time of year and even if you vowed not to over spend, there was probably that one gift you couldn’t resist. No worries we can help identify areas that can help pay out your debit and save you money that you can invest in your RRSP.

C: Contribution Limits

Yes, there are limits on what you can contribute to your RRSP. Contributions are either 18% of your pre-tax earned income, or to a maximum of $26,230.00. Contributions made in 2018 and the first sixty days of the new year can be used on your tax return to reduce taxable income.

The deadline for contribution for 2018 is March 1, 2019.

D: Diversification

Diversification is a risk management strategy that mixes a variety of investments within a portfolio. If a portfolio is properly diversified and constructed with different kinds of investments it’s more likely to generate higher returns and minimize risk for you, the investor*.

E: Exchange-Traded Fund (ETF)

What is an ETF? An exchange-traded fund (ETF) is an investment fund similar to a Mutual Fund, but it tracks an index like the S&P500 and is traded on stock exchanges. ETFs typically have lower fees than mutual funds and can hold assets like stocks, commodities, or bonds just like a mutual fund. Our Investment Partners use them to construct your portfolio – contact us to find out more.

F: Freedom

Having professional portfolio managers manage your investments can help free up your time, so you can enjoy spending more time on the things that matter.

G: Goals of the Retirement Kind

Having enough money for a comfortable and secure retirement is a great financial goal that everyone should have. Maxing out the contribution limit in your RRSP is one way to help you get there faster. However, you need to understand all your Investment vehicles including what pension income you will have before you maximize your RRSP account. You might have other financial goals including things like saving for your child’s or grandchild’s education or saving up for that dream vacation!

H: Holdings

Holdings are what your portfolio is made up of (like ETFs, options, bonds…etc.) The kind of holdings, and how many you have in your portfolio, can contribute to how diversified your portfolio is*.

I: Income

Having an income is necessary to building wealth and living! Income can be defined as money a person receives in exchange for providing goods or services. Income in Retirement is the amount you earn from savings to fund the things you want to do.

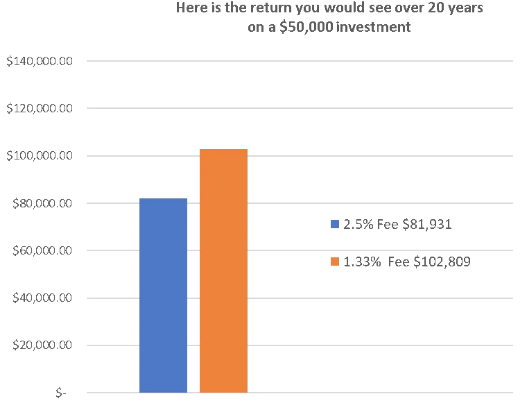

J: Justifying Fees

Can you justify paying high fees on your investments that eat up your returns? The value that your advisor provides is important, and they can help guide you towards all of your goals. This doesn’t mean you need to pay high fees for professional advice! It could be time to look at working with a firm like ours where we offer an investment platform without the high fees and without sacrificing sound financial advice and investment returns.

K: Know Your Client (KYC)

The Know Your Client (KYC) is a standard form in the investment industry that ensures advisors know detailed information about their clients’ risk tolerance, investment knowledge, and financial situation*. In other words, it’s how we get to know you at first!

L: Low Fees

Paying lower fees on your investments means more money for your bottom line in retirement.

M: Money

Money makes the word go around and making regular contributions to your RRSP can ensure you have enough money for a comfortable and secure retirement.

N: New Investment Platforms – you have choice!

Our Partners at Nest Wealth are Canada’s first “robo-advisor”, offering a simple and easy way to investing. Using smart technology and proven investment principles, they can monitor and manage your custom portfolio at a fraction of the cost.

They take a passive approach to investing and build your portfolio to “be the market”, not “beat the market”, because history has proven time and time again that you’re likely to accumulate more wealth by investing passively. So, while you’re busy with life, your Nest Wealth Portfolio Manager is busy monitoring and rebalancing your portfolio, and ensuring your assets are properly diversified, in order to help you achieve your financial goals.

Does this mean you don’t have an advisor? Not at all. We have Partnered with Nest Wealth to offer clients discretionary portfolio management, while we define, create and manage your financial plan and all the details that go into working with you to reach your unique and personalized goals.

O: Opportunities

Opportunities are the things you want to do! What do you want to do in five years, or fifteen years from today? We can help you plan and achieve these opportunities.

P: Passive Management

Passive management is an investing strategy and is the opposite of active management. Passive managers track the market and know successful investing is about time in the market, whereas active managers aim to time the market in order to beat it. Research has shown passive investing outperforms those that are trying to beat the stock market. Using this as a foundation, your portfolio will be designed to “be the market”, not try to “beat the market”, meaning our clients have constructed portfolios at a lower cost and are also likely to outperform most traditional portfolios over the long run.

Q: Questions

We know that you have questions about your financial planning activities, and we are always available to answer them for you. Be it over messenger, email, a phone call, or in person, we’re here when you need us.

R: Retirement

According to a study by Statistics Canada, 31% of those surveyed between ages 45 and 60 said their financial preparations for retirement were insufficient. Further, a study by RBC revealed 56% of non-retired Canadians were worried they wouldn’t be able to enjoy the life in which they are currently accustomed to. Are you worried? Will you be able to enjoy the lifestyle you want for you and your family?

S: Savings

Savings will typically be a savings account, and will be used to pay for kid’s activities, vacations or even those unexpected expenses. Savings allows us to use less credit, and ultimately ease our financial stress. We can’t rely on savings to fund our long-term goals, like retirement. Why? Because money in a savings account earns minimal interest and produces minimal growth.

Investing, on the other hand, can help grow your investments for long term goals like retirement. The question isn’t if you should save or invest, it’s how much money you should put towards your savings and how much should you put towards your investments. Working with an advisor can help you determine the best allocations.

T: Tax-Free

RRSPs have many benefits, two of which are not to be ignored: the tax refund you receive when you contribute to your RRSP, and tax-deferred growth. Money in your RRSP will eventually be taxed when you withdraw it, but because most people earn less income in retirement, the withdrawals should end up being taxed at a lower rate!

U: Unique

Each client is unique, so we work with you to identify your opportunities and then work with our Portfolio Manager to construct a custom portfolio for you.

V: Value

Investment fees in Canada are way too high. As I mentioned earlier, the value of using a Professional Financial Advisor is paramount. There are studies that show clients who work with an advisor are more likely to achieve their retirement goals than those who don’t. But quality advice shouldn’t be mistaken for high investment fees. As a client you need to ask yourself, is the advice I am receiving worth the thousands of dollars in fees that I am paying each year.

W: Wealth

What does Wealth mean to you? At Zakus Kowalchuk LLP, wealth means having more time, freedom, and choice. More time for our clients to spend on the things that matter most to them, more freedom for our clients to spend their time as they wish, and more choice as to how our clients spend their time and freedom on what brings them the most happiness.

Looking at it another way, to the young professional, wealth may mean being able to afford rent, food, and some after work drinks with coworkers. To the athlete, wealth may mean being able to afford equipment and training. To the cancer survivor, wealth may mean having a clean bill of health. And to the grandmother with five grandchildren and three great grandchildren, family may be the greatest form of wealth.

Have you ever heard the saying – you can always make more money, but you can’t make more time!

X: X Marks the Spot

X marks your target, whether it is a short-term opportunity or longer-term objective, meeting with an advisor can help you start mapping out your financial future.

Y: Yield

Yield is the income return on an investment (like interest or dividends) *.

Z: Zzz

I could have talked about having a “Zero Balance Credit Card” but to me the letter “Z” is the sound of you sleeping peacefully knowing you have a Financial Plan and that your portfolio is in good hands.

Final Thoughts

Regardless of your view of the market, contributing to an RRSP is a smart money move and is one strategy in the journey to creating opportunities for you and your family!

*Definitions sourced from www.investopedia.com

Want to discuss your RRSP Strategy? Please email [email protected] or call 778-215-7230 for a chat.

Want more Insurance and retirement savings tips? Sign up for our free newsletter on our home page.

The information contained in this post is of general nature and should not be considered professional advice. Its accuracy or completeness is not guaranteed, and Zakus Kowalchuk LLP assumes no responsibility or liability